iAgri Support

Tax returns

Tax returns are the most common reports used in iAgri Online. They are very important to get right, as the IRD or tax department within your country require thorough and correct information on your business.

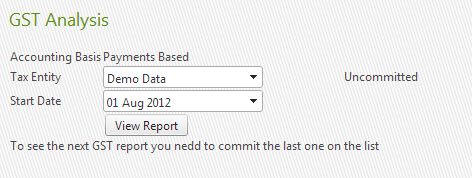

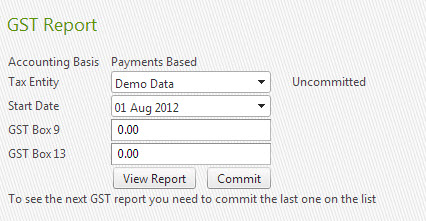

At the end of each tax period it is necessary to allocate transactions to that period; this is called "committing". The purpose of this is that once entries have been committed, they cannot be inadvertently deleted or changed and thus cannot cause your cashbook to be out of sync with returns already submitted to the tax department.

Questions

How do I change a transaction that is already in a committed Tax Return?

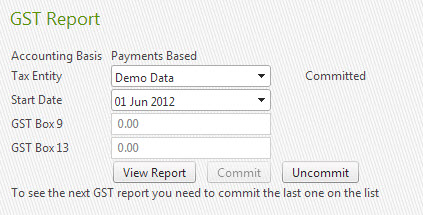

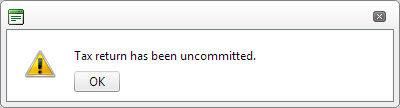

You can uncommit the return by using the uncommit function explained here.

What happens if I add a transaction that falls into the period that has already been committed to a tax return & sent to the tax department?

Add the transaction as normal and the transaction will automatically come through into the next GST return, within Boxes 9 or 13.

What happens if I forgot to anaylse a transaction that falls into the period that has already been committed to a tax return & sent to the tax department?

If the transaction/s don't have Tax then you can just analyse them as normal and it won't effect any of your Tax Returns.

If the transaction/s do have tax, then analyse the transaction and the Tax will flow through into the current Tax period (within either Box 9 or 13)

What happens if I change a transaction that has already been committed to a tax return BUT NOT been sent to the tax department?

Currently you cannot change a transaction that has been included in a comitted tax return, you will need to uncommit the return by using the uncommit function explained here.

What happens if I add a transaction that falls into the period that has already been committed to a tax return BUT NOT been sent to the tax department?

You can uncommit the return by using the uncommit function explained here. Then you would recommit the return again to include the added transaction and send to the tax department.