iAgri Support

Reconcile bank transactions

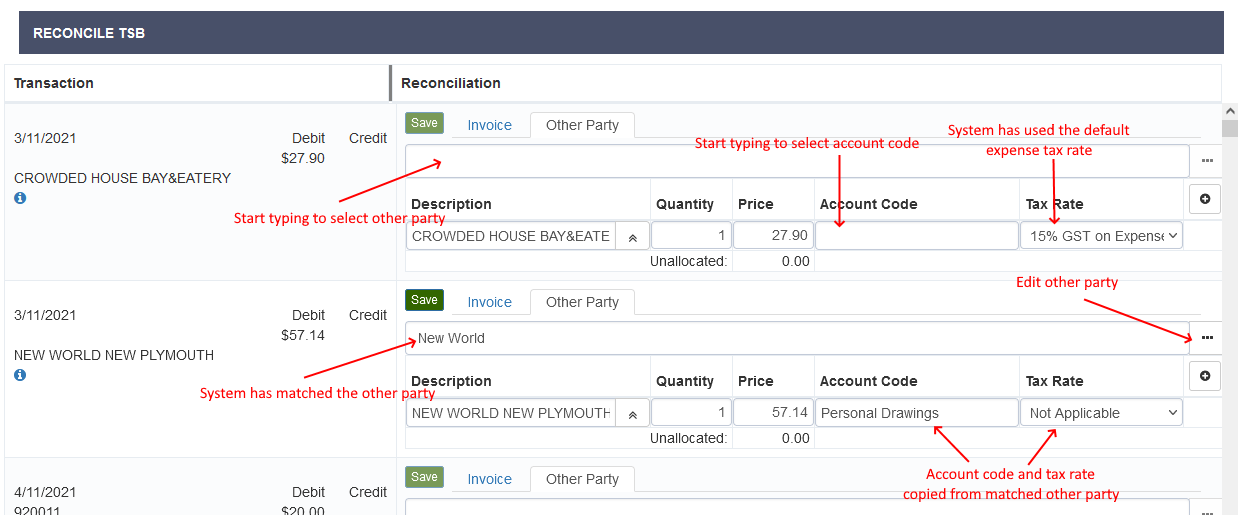

The system contains a powerful transaction reconciliation engine. The system will attempt to reconcile transactions based on previously entered data. You can fine tune the results and save the reconciled transactions. When you open the reconcillation page, the system will attempt it's "best guess" at how the transaction should be reconciled. You can correct any errors, add additional information, and save each transaction, marking it as reconciled.

In the example, The first transaction has not matched an existing Other Party, so the default tax rate for purchases has been selected. Default tax rates can be configured in the Tax Rates page.

The system has matched the second transaction against the existing Other Party "New World" because the name matches the start of the transaction description field. The account code and tax rate for New World has been selected for the transaction.

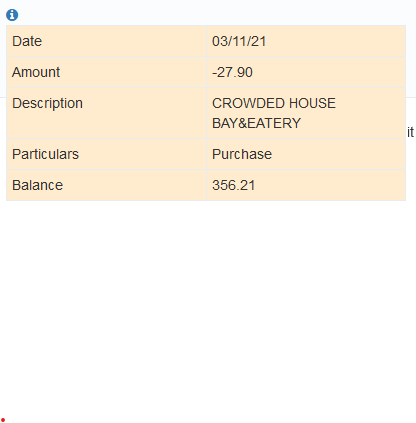

You can see more information about imported transactions by clicking the blue information symbol in the left hand column. This will display a pop-over with all the details from the imported statement.

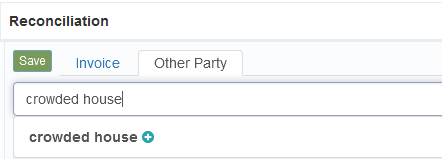

When you start to type in the Other Party text box, the system will try to find the matching Other Party and display these for selection.

In this case, there are no matches, so the newly typed other party name is displayed with a green plus icon, to indicate it can be created as a new entry. When you click on this entry, a new other party record is created and associated to the transaction.

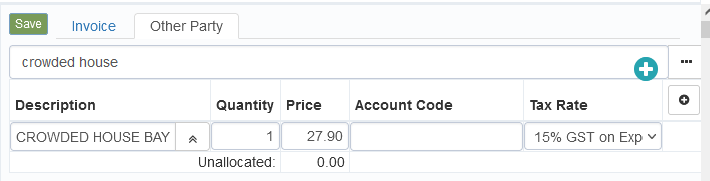

The green plus icon is displayed with the other party entry to indicate this is a new record. Click the elipsis button "..." the the right of the other party text box to configure the other party.

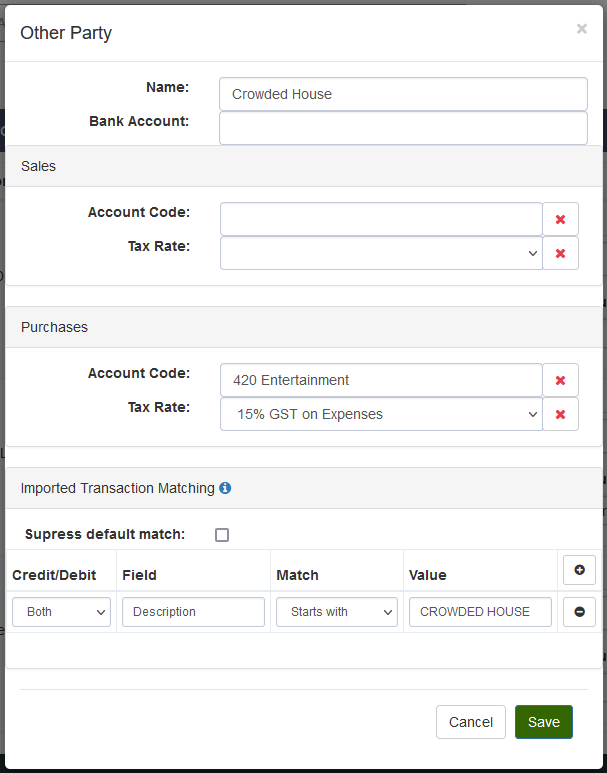

In this example we have changed the name of the other party to capitalise the start of each part o the name, selected an account code and tax rate for purchases and added a transaction matching rule. Click save and the other party and transaction records will be updated with these changes.

Matching rules can be added to any Other Party record to help the system find the correct Other Party when matching transactions. The rule will be matched against the specified field from the imported statement. To match any field in the statement, leave the Field blank.

Note:

In this example, the matching rule is unnecessary, because the Other Party name would match the start of the description field from the imported transaction.

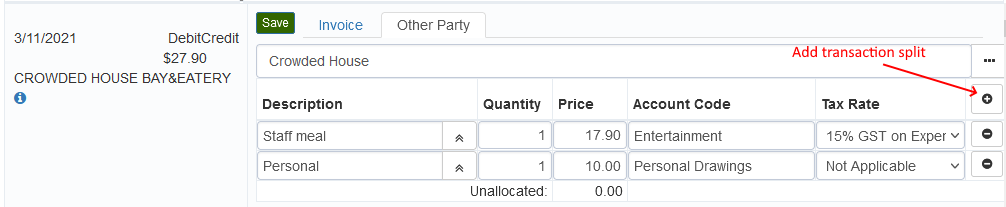

Use the add split button to split the transaction across account codes and tax rates.

In this example, the transaction has been split into 2 line items with different descriptions, account codes and tax rates. The save button for the transaction is enables when the account codes and tax rates for each line item is set, and the sum of the line item prices match the transaction amount.

Click save to save the reconciliation and mark the transaction as reconciled.