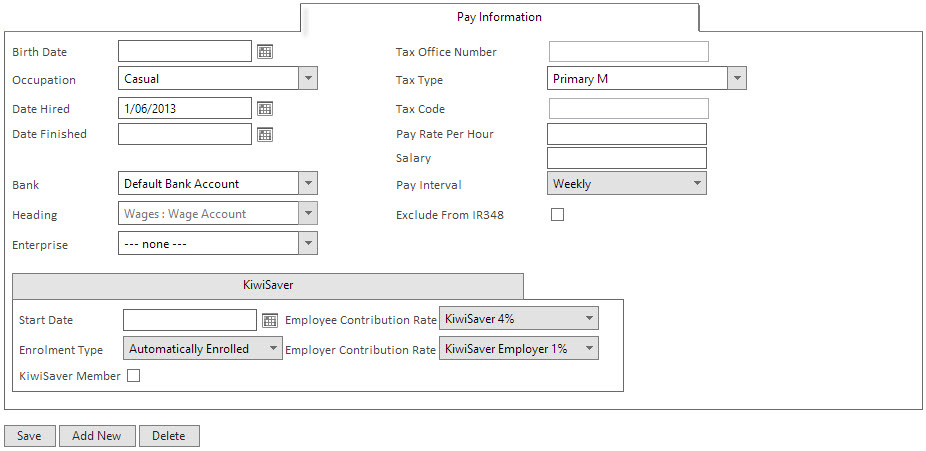

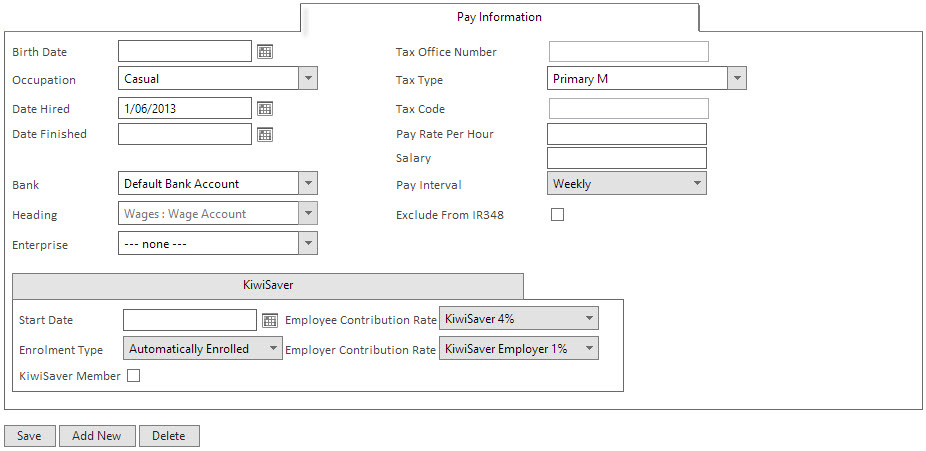

Add pay details

|

Once you have added the employees contact details into the address book:

- Tick the Show in Wage Book tick box at bottom of the address book

- Select the Pay Information tab once it becomes live

- Fill in the Pay information for the Employee

Birth Date : Date of birth for the employee

Occupation (required) : Type of Employee, select from list

Date Hired (required) : Important to record for future reference

Date Finished : If client has finished employment, please fill in

Bank : The bank account the payments come out of

Heading : The Wage heading

Enterprise : The enterprise of you record payments against

Tax Office Number : Employees IRD number

Tax Type (required) : The Type of Tax the Employee is Taxed at

Tax Code : The code assigned to this Tax Type, ie M SL

Pay Rate Per Hour : Use if the employee is on Hourly Payment

Salary : Use if employee is on Salary

Pay Interval (required) : Time between pays

Exclude From IR348 : Tick to exclude from the IR 348 report.

Kiwisaver

Start Date : When the employee started Kiwisaver with you

Enrolment Type (required) : Type of Kiwisaver employement

Kiwisaver Member : Tick if they recieve kiwisaver

Employee Contribution Rate : What rate the Employee contributes to kiwisaver

Employer Contribution Rate : What rate the Employer contributes to kiwisaver

Deductions, Contributions and Allowances are added in the Wagebook

- Click the Save button

- Click OK button

Once the Payment details are created, you can start creating pays in the Wagebook

|